Disclaimer: I am just sharing my information, not suggesting you to buy any stocks or investments. Use the info here at your own risk. Please make your own judgements when making investment decisions.

In my last blog post on how to evaluate a stock, I listed three methods when valuing a stock:

- P/E Multiple method

- DCF model

- Return on equity valuation method

Today I am going to deep dive into the first method: The PE multiple method.

We use Ciena (NYSE:CIEN) as an example. We’ll answer this question, is CIEN current price $44.28 over valued? Can I buy CIEN at this price?

P/E Multiple method

You determine stock’s five-year price target based on P/E valuation.

Those are all the inputs:

a. EPS (ttm): Earnings per share for the trailing twelve months is usually included in the stock information of a given stock in most financial websites such as morningstar.

CIEN trailing twelve month P/E:

| EPS (TTM) | 2.41 |

Source: https://finance.yahoo.com/quote/CIEN?p=CIEN&.tsrc=fin-srch

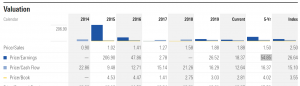

b. the median historical price-earning multiple. We look at the past five years.

| 54.85 |

Source: https://www.morningstar.com/stocks/xnys/cien/valuation

Per YChats, it is 54.37 (Average, Past 5 Years; https://ycharts.com/companies/CIEN/pe_ratio)

It’s PE as of Friday Sept. 4, 2020 is 18.37.

c. Expected growth rate

Next 5 Years (per annum) 8.90%

Source: https://finance.yahoo.com/quote/CIEN/analysis?p=CIEN

This is the rate CIEN is expected to grow its profit in the next 5 years.

However, forecast is skeptical, especially Wall Street tends to provide higher estimate than in reality. So let’s apply some discount such as 25% as our margin of safety.

so 8.90%*(1-0.25)=0.06675

so let’s give it 6.67%, being conservative.

Next, we put all those together to get the price target for the next 5 years:

EPS*avg hist P/E ratio*growth rate^5, that is:

2.41*54.85*(1+6.67%)^5=182.559799432

This is the price target in 5 years for this stock.

However, we are most interested in the intrinsic value of this stock now so assuming stock market returns 9% annually, here we calculate the intrinsic value of the stock (or we call it Net Present Value, NPV):

5-year price target / (1+9%)^5, that is:

182.559799432/(1+9%)^5=118.651343527

You can replace it with other numbers instead of 9% if you want to achieve say 20% per year for the next 5 years.

As you can see, if you feel avg hist P/E ratio (for the last 5 years) 54.85 is comfortable, CIEN is a great bargain, as at the time of this writing as it is trading at 44.28 at the close of 9/4 Friday, after two consecutive drops of the broad stock market last week.

Somehow I don’t feel this PE for the last 5 years for CIEN is good to estimate for the next 5 years, as its value was spiked because of some sudden PE changes in 2015 such as this peak PE:

| Maximum | 281.11 | Nov 27 2015 |

So if I use current PE 18.37 (as of 9/4/2020 Friday market close) I have the following target price for this stock:

2.41*18.37*(1+6.67%)^5=61.1417231643

NPV for current:

61.1417231643/(1+9%)^5=39.7379248968

If I believe my intrinsic value of CIEN, I will consider buying it below $39.73 per share. That’s close to its price 39.34 on Mar 27, 2020

Before the broad stock market drop last week, CIEN was traded at 60.07 when market closed on Wednesday 9/2.

Yahoo site says this stock price now is Near Fair Value.

According to GuruFocus, Ciena Intrinsic Value: Projected FCF : USD 33.40 (As of Today).

https://trendshare.org/stocks/CIEN/view:

| CIEN Price (Ciena Corporation stock price per share) |

$59.93 | |

| [?] | CIEN Fair Price (based on intrinsic value) |

$25.84 |

| [?] | CIEN Safety Price (based on a variable margin of safety) | $15.50 |